From the beach 2015

Key issues faced by New Zealand businesses this year include the flow-on effects from lower oil and dairy prices, while migration’s influence on the supply of labour and the housing market will also be important.

What does the drop in oil prices mean?

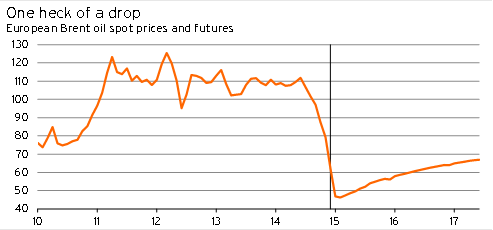

Falling oil prices have been an issue that’s come out of left field in recent months. From a peak of US$115/bl in June last year, Brent oil prices have more than halved, dipping below US$50/bl in January this year.

The drop in prices is symptomatic of both demand and supply factors. In the US, for example, oil consumption in 2013 was lower than at any time between 1998 and 2008. Across Europe and Eurasia, total oil usage has not been lower since 1970.

Between 2008 and 2013, a 47% increase in oil production in the US represented 85% of the worldwide lift in production over that five-year period. Investment in the extraction of oil from tar sands and shale has been behind the lift in supply.

What do low oil prices mean for the economy in 2015? In areas with a relatively positive economic outlook, such as the US and New Zealand, lower fuel prices will act as a stimulus to economic growth, boosting consumers’ discretionary spending and helping to keep business costs down. In New Zealand, the total effect could free up more than $1.5bn for households to spend on other goods and services – which would represent a 1.1% lift in private consumption.

The effects are not so clear-cut in Europe and Japan, where deflationary concerns and a lack of economic growth are dominating the outlook. Falling fuel prices might simply add to the overall downward pressure on prices. Households will be further discouraged from spending given the mix of uncertain economic conditions and the likelihood that goods and services will be cheaper in future if they are willing to wait.

Graph 1

Another outcome of the plunge in oil prices is that it is likely to undermine further short-term or medium-term investment in extraction and refining, particularly for more expensive sources of oil. OPEC’s decision in late 2014 not to cut production, which was a significant factor helping to drive oil prices even lower, might have been made with this longer-term view in mind. By suffering lower profits now, OPEC could be trying to protect future profits by reducing the incentive for other producers to expand output over the medium-term.

Oil futures prices are currently US$10/bl higher by the end of this year, with further gradual rises thereafter. These figures suggest that oil prices are unlikely to fall (much) more – make the most of them this year!

A slow road to dairy recovery

Lower oil prices are effectively adding more money back into the economy, but lower dairy prices are taking even more out. Allowing for a 5.5% increase in production levels this season compared with 2013/14, total dairy incomes will still drop by $6.3bn if Fonterra’s current payout forecast of $4.70/kgms is correct.

We have previously written about the disproportionately large effect the drop in dairy prices will have on regions such as Waikato, Taranaki, Canterbury, and Southland. Businesses operating in these regions, particularly outside the main urban centres, need to be prepared for more difficult trading conditions, given that the aggregate dairy payout will be at its lowest since 2009/10. For locally based SMEs, it is imperative to keep a tight rein on costs, take a cautious approach to hiring or investment, and manage stock levels carefully. For nationally based firms, being aware of the difference in regional performance is critical to ensure that a one-size fits all approach is not detrimentally foisted on areas where demand conditions are simply not there to support much growth.

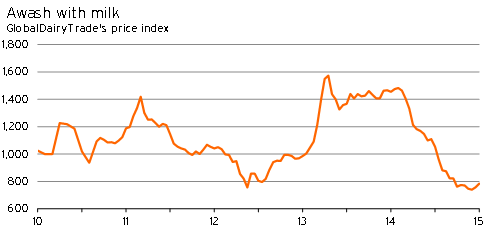

International dairy spot prices have rebounded 6.0% since the start of December but are still 47% below their February 2013 peak. A lift of another 35%, taking spot prices back to their July 2013 level, would return the farmgate milk price back to its average of the last decade. However, the timing of additional increases in international dairy prices seems to be largely reliant on production trends overseas. The bad news is that European production levels are still running about 4-5% higher than a year ago. Low oil prices are keeping production costs down for more energy-intensive farming models in the US and Europe, and with the removal of European production quotas looming in a few months’ time, the outlook for international supply levels remains high. Although the payout may be at its low point in the current season, businesses should plan on a slow recovery in dairy prices, meaning that the prospect of relatively difficult trading conditions in some provincial areas is likely to last beyond 2015.

Graph 2

Getting staff only likely to get harder

A year ago we warned that the rapidly tightening labour market could start to have significant implications for businesses’ ability to recruit and retain staff. Within the last year, New Zealand’s employment growth has been at its fastest in almost two decades. Finding both skilled and unskilled labour has been getting more difficult, although the unemployment rate, at 5.4%, still hints at some spare capacity in the economy.

One factor that points even more strongly towards spare capacity is the lack of wage inflation. Both the labour cost index and wage inflation from the quarterly employment survey are running about a percentage point below their average of the last decade. In real terms, wage inflation still looks reasonably good from an employee’s point of view because consumer price inflation has been so subdued. Even so, one would expect employees to be seeking bigger pay increases if their bargaining position allowed it.

Anecdotal reports of increased labour market pressures in specific areas, particularly around transport and construction in Canterbury, have become more common over recent months. More broadly, we believe that businesses need to be aware of the mounting risks around staff retention over coming quarters, particularly once migration peaks and working-age population growth starts to slow.

Housing’s time comes again

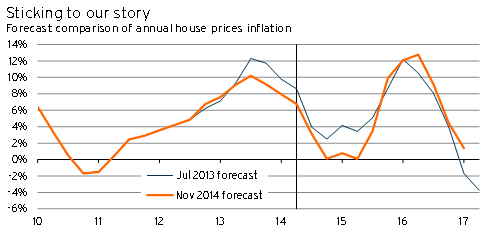

Since mid-2013, we’ve been predicting a renewed rally in the housing market during 2015. But the emphasis of this outlook has changed a little over the last 18 months. The reversal in dairy prices implies that any resurgence in house prices is most likely in the undersupplied Auckland market, and will not be as evenly spread across the country as we originally thought.

Graph 3

The Reserve Bank’s loan-to-value ratio restrictions sapped the housing market’s momentum throughout much of 2014, but there are small signs of life reappearing in some of the most recent data. House price inflation in Auckland looks to be accelerating again, and data from Barfoot & Thompson shows that their listing numbers have plunged 24% (seasonally adjusted) over the last five months to an all-time low. Nationwide sales activity in November was the second strongest for any month since July 2007.

High levels of migration have been coupled with solid economic growth and a reversal in fixed mortgage rates during the latter part of 2014. Conditions remain ripe for another pick-up in the housing market – our most recent forecasts, published late last year, saw house price inflation reaching 13%pa by mid-2016.

Such an outcome would be unpalatable for the Reserve Bank and other policymakers, but is a reflection of persistent supply issues in New Zealand’s largest city. Further increases in property prices will expedite more residential construction activity and help reinforce the government’s efforts to improve the supply of housing via the Auckland Housing Accord.

However, the Reserve Bank has also indicated that it will consider further measures to quell the housing market if necessary. One of the side-effects of the LVR restrictions is that they have led to fewer first-home buyers in the market, making it easier for investors to purchase property. The Bank has been doing some work looking at additional tools to curb investor demand for housing without pushing up the official cash rate. Given a likely pick-up in house price inflation in coming months, we would not be surprised if new restrictions are introduced by the Bank later this year.